"*" indicates required fields

Don’t view additional covers as a gamble that might not pay off. Ultimately, you never know what’s round the corner and comprehensive insurance cover makes sure you’re financially protected whatever happens.

Our job as your broker is to advise on the additional covers you should consider. These include…

Provides a ‘top-up’ on policies such as Employers’ Liability and Public Liability insurance limits if your insurer is not able to fully insure the whole of your risk.

If you have to make a claim, your Loss Recovery Insurance will give you access to an independent Loss Adjuster who will negotiate with insurers on your behalf and help you recover from the incident as quickly as possible.

This will cover you if you need to repair environmental or pollution-related damage caused by your business activities.

You’ll need additional Terrorism Insurance to cover you if a terror attack impacts your business.

It won’t be automatically included in your existing policies.

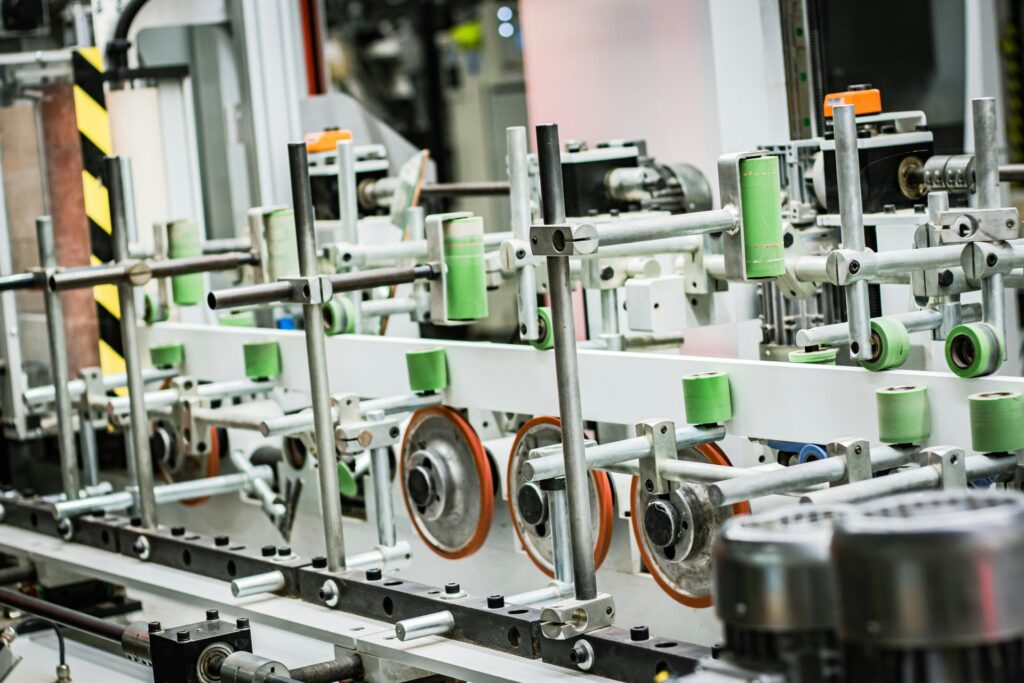

This cover will protect against unforeseen breakdowns in elecctrical and mechanical equipment.

A Deep Dive into Equipment Breakdown insurance, including what’s covered and what’s not.

Discover the risks you need to be aware of and learn the importance of Terrorism Insurance.

Find out more about additional covers, including case studies and advice from our experts.

"*" indicates required fields

Call: 0113 281 8110

Romero House, 8 Airport West

Lancaster Way, Yeadon

Leeds, LS19 7ZA

© Romero Insurance Brokers Ltd Registered in England & Wales no. 03362483 Romero Insurance Brokers Is Authorised & Regulated by the Financial Conduct Authority no. 304872

Book Now For March

Sentient’s next 3 day IOSH Managing Safely® course is now available to book.